We recently saw Lynas' (OTCQX:LYSDY) Q3 cash-flow figures. The company has been making improvements to its L.A.M.P. facility, which had been operating inefficiently relative to its capacity and management's expectations. These improvements led the company to report positive free cash-flow in the second quarter. While investors were enthusiastic we note that during that quarter REE prices fell significantly, so that Lynas' realized price going forward would likely be considerably lower than they had been. REE-prices were weak during Q3, but the bulk of the decline was in Q2 so we are better positioned to judge Lynas' ability to generate cash-flow after seeing its Q3 numbers.

The company generated A$1.3 million ($945,000) in operating cash-flow in Q3 on revenues A$55.9 million ($40.6 million) on the sale of 2,700 tonnes of TREO at $15.03/kg. This is higher than current prices, and we note that the company produced 3,200 tonnes while only selling 2,700, meaning it is possible that the company didn't sell all of its low-value REOs (e.g. lanthanum and cerium). Were Lynas to sell all of its REOs we estimate that at today's prices it would generate ~$12.50/kg., with ~$9.60 coming from Pr/Nd.

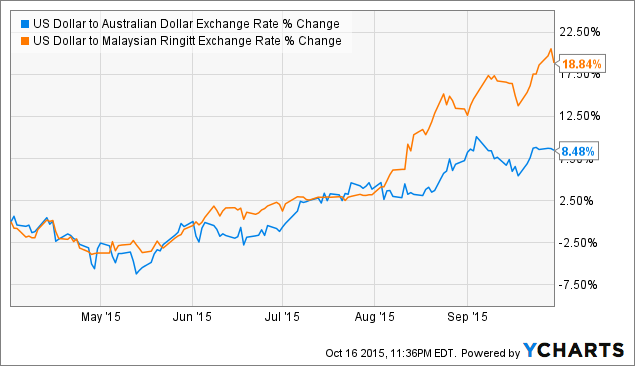

$945,000 in cash-flow works out to OCF of $0.35/kg., which means that the company essentially broke even in the quarter. We won't discount operational improvements--which are evident from the fact that the company is no longer hemorrhaging cash--yet must note the substantial currency tailwinds the company's experienced. The following charts the USD in terms of the Aussie dollar and the Malaysian Ringitt during Q2-Q3

US Dollar to Australian Dollar Exchange Rate data by YChartsIt is evident that both currencies in which Lynas has operating expenses fell considerably against the USD in Q3.

While Lynas has been continuing to make improvements we find it difficult to believe that the company is generating positive operating cash-flow at current prices, which we again emphasize are somewhat lower than the average Q3 prices. We will note, however, that neodymium prices have ticked upward for the first time in several months, suggesting that prices might have seen their worst. With Lynas expected to generate more than half of its revenue from Nd that is an excellent development. But if Lynas is producing REEs at $14.70/kg. it cannot make money in this environment given its basket.

The investment case for Lynas is a precarious one at this point considering that the company's debt position puts it at risk of not being able to meet its obligations if prices don't turn around in a timely manner. Furthermore, we believe that the upside potential is limited considering company's debt position, which gives it an NEV of ~$500 million. With 12,000 tonnes of annual TREO production the company would have to generate ~$19/kg. of TREO in order to be trading at an NEV/OCF ratio of ~10. That implies a 50% increase in REO prices for us to see a valuation that doesn't seem expensive. Of course, given the relative difficulty of producing and selling REE-products one might choose to discount this risk by ascribing it a lower valuation.

So we don't think Lynas is cheap, and while its debt-load isn't an immediate threat it is a burden. Anybody looking for tremendous upside in REEs will be able to find other opportunities as higher prices will create winners among the juniors. Anybody owning REEs and not looking for tremendous long-term upside in these materials will find better risk/reward opportunities in other, simpler resources.

Finally on Lynas, the company announced its intent to enter the high purity REE space. Our research on Texas Rare Earth Resources (OTCQX:TRER) has touched on this, since the company has been contracted by the Defense Logistics Agency to purify yttrium, ytterbium, and a third unnamed element. Few details were provided by Lynas. We don't know, for instance, which materials they wish to separate, how much of each they believe they can produce, and what chemistry they intend to use. We suspect the company would need to produce a sizable amount of high purity products in order to move the needle, and we wonder if the company has the capital to develop the necessary L.A.M.P. expansion and what it has to prove in order to make up any capital shortfall.

- Forums

- ASX - By Stock

- LYC

- So we don't think Lynas is cheap...

LYC

lynas rare earths limited

Add to My Watchlist

2.78%

!

$9.99

!

$9.99

So we don't think Lynas is cheap..., page-8

Featured News

Add to My Watchlist

What is My Watchlist?

A personalised tool to help users track selected stocks. Delivering real-time notifications on price updates, announcements, and performance stats on each to help make informed investment decisions.

(20min delay) (20min delay)

|

|||||

|

Last

$9.99 |

Change

0.270(2.78%) |

Mkt cap ! $9.345B | |||

| Open | High | Low | Value | Volume |

| $9.75 | $10.15 | $9.71 | $68.77M | 6.987M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 1 | 900 | $9.97 |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| $10.00 | 15550 | 7 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 1 | 900 | 9.970 |

| 2 | 9000 | 9.950 |

| 2 | 8000 | 9.940 |

| 3 | 7311 | 9.920 |

| 4 | 5897 | 9.900 |

| Price($) | Vol. | No. |

|---|---|---|

| 10.000 | 12984 | 5 |

| 10.020 | 29794 | 1 |

| 10.030 | 2311 | 2 |

| 10.040 | 997 | 1 |

| 10.050 | 24167 | 9 |

| Last trade - 16.10pm 18/07/2025 (20 minute delay) ? |

Featured News

| LYC (ASX) Chart |