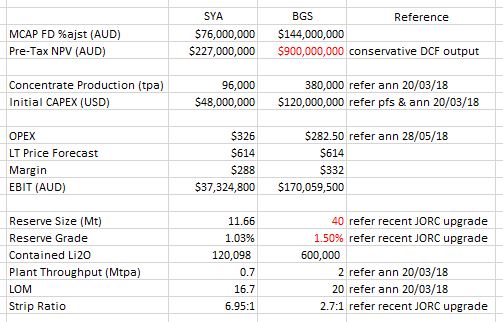

Since you are unable or can't be bothered to research, I have added references to the figures I provided, so you can so you can save your passive aggressive comments about me fudging numbers. As you (should) be able to see, I placed a factor of safety on CAPEX & OPEX in prior renditions of this table, but strictly going by the company's releases, we see the following:

I'm not sure why you keep insinuating that BGS is doomed to fail because the infrastructure in Mali isn't as good as Canada. All required infrastructure for the mine and getting the product to port exists, hydro-power in the vicinity of the project, sealed roads all the way from Bougouni to Abidjan or Dakar, with rail options to each city as well currently in operation and under major upgrades.

You could argue that the superior infrastructure in Canada might allow for lower operating costs, but BGS has advised that costs will be sub $290/t, which is far cheaper than SYA. In addition CAPEX intensity is lower than SYA, so project costs are cheaper on both fronts.

Given the demand for lithium, SYA will probably get financed, but how much upside does it have? Maybe 100 - 200% best case, given the current project figures. While BGS easily offers 600% - 1,000% on the numbers before we even start talking about secondary processing options.

This leads me to your comment about secondary processing. All hard rock plays will be looking to participate in downstream processing facilities, everyone knows that they multiply potential earnings - I have been outspoken on this topic. However, a project should be judged on its stage 1 merit before discussing secondary processing which requires serious technical capability and significant additional funding. As I said, all hard rock players are looking at it, SYA isn't a special snowflake and if BGS manages to lock up an off-take with a major with battery manufacturing facilities in Europe, I would bet my bottom dollar on a downstream processing facility being established en-route from Bougouni to the battery manufacturing hub that is developing in Europe.

Again, with the government of Mali extremely supportive of mining, offering tax holidays & VAT exceptions, rapid permitting, tax holidays, publicly stating desire for FDI in mining projects, especially non-gold mining projects, and BGS directly, I would comfortably bet that this project will be up and running while SYA are still filling out a mountain of bureaucratic paperwork.

- Forums

- Commodities

- SYA BGS comparison

Since you are unable or can't be bothered to research, I have...

- There are more pages in this discussion • 8 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)