The Three Ds of Doom: Debt, Default, Depression

July 17, 2019

"Borrowing our way out of debt" generates the three Ds of Doom: debt leads to default whichushers in Depression.

.

Let's start by defining Economic Depression:a Depression is a Recession thatisn't fixed by conventional fiscal and monetary stimulus. In other words, when a recessiondrags on despite massive fiscal and monetary stimulus being thrown into the economy, then thestimulus-resistant stagnation is called a Depression.

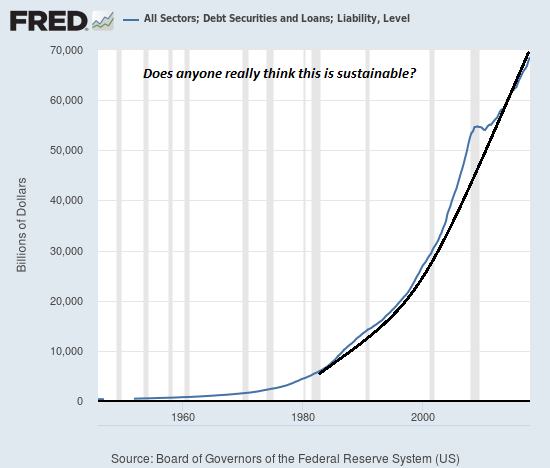

.Here's why we're heading into a Depression: debt exhaustion. As the charts belowillustrate, the U.S. (and global) economy has only "grown" in the 21st century by expandingdebt roughly four times faster than GDP or earned income.

.

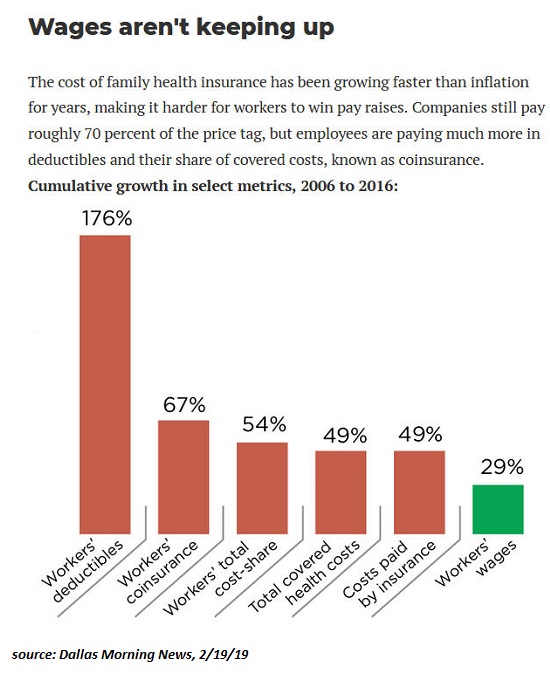

Costs for big-ticket essentials such as housing, healthcare and government services aresoaring while wages stagnate or decline in purchasing power. What's purchasing power?Rather than get caught in the endless thicket of defining inflation, ask yourself this:how much of X does one hour of labor buy now compared to 20 years ago? For example,how much healthcare does an hour of labor buy now? How many days of rent does an hour of laborbuy now compared to 1999? How many hours of labor are required to pay a parking ticket nowcompared to 1999?.

Our earnings are buying less of every big-ticket expense that's essential, and we've coveredthe gigantic hole in our budget with debt. The only way the status quo could continue conjuringan illusion of "prosperity" is by borrowing fantastic sums of money, all to be paid with futureearnings and taxes..

At some point, the borrower is unable to borrow more. Even at 0.1% rate ofinterest, borrowers can't borrow more because they can't even manage the principal payment,never mind the interest. That's debt exhaustion: borrowers can't borrow more withoutramping up the risk of default.When wages are stagnant and big-ticket items are soaring in cost, that leaves less availableto service more debt. We can cover expenses by borrowing more for a while, but there's anendgame to this trick: even at zero interest, servicing the debt exceeds income.

.

Marginal borrowers default, and the resulting losses collapse marginal lenders. Recallthat every debt is somebody else's asset and income stream. When a student defaults ona student loan, that erases the asset and income stream of a mutual fund, pension fund, etc..

In other words, defaults are not cost free. They wipe out assets and income streams, never toreturn..

For the past 20 years, the trick to escaping recessions has been to lower interest ratesand flood the financial system with new credit. If everyone would just borrow more andspend every cent of the new money, the economy will start "growing" again..

But we've reached the point where most wage earners can't borrow more, corporations shouldn'tborrow more and the top tier of earners no longer want to borrow more. Governments canalways borrow more, but eventually servicing the ballooning debt starts crowding out otherspending, and the solution--borrowing more to cover the interest payments--spirals out of control..

Lowering interest rates and giving banks and financiers "free money" doesn't increasewages or household incomes or corporate profits. Nor do these monetary tricks magicallyturn marginal borrowers into creditworthy risks..

Borrowing more to fill the hole left by declining purchasing power only works in the short-term.We've burned the 20 years that this trickery can work, and now we face the endgame: borrowingmore only increases defaults, which trigger losses in wealth and income that will be measured in the trillions..

Take a look at systemwide debt in the U.S. Does this look remotely sustainable? If theanswer is yes, you might want to dial back your Ibogaine consumption.

..

.

.

.

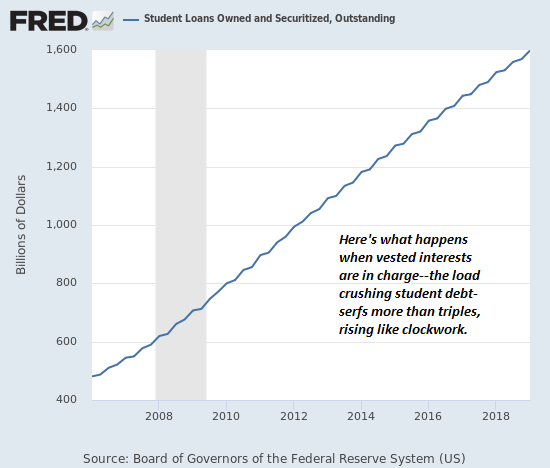

Here's student loans. One trillion here and one trillion there, and pretty soon you'retalking about entire generations of debt-serfs and a bunch of pension funds that are goingto suffer catastrophic losses when the student borrowers default.

.

.

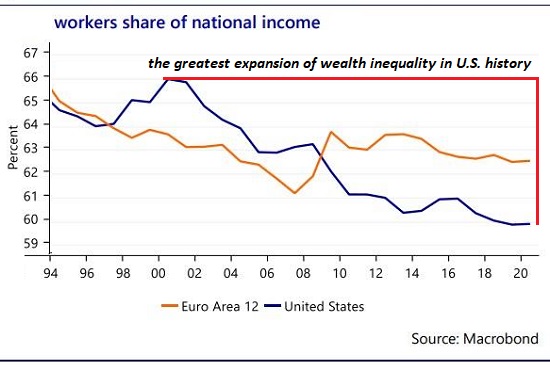

.Meanwhile, labor's share of the economy (wages and salaries) has been in structural declinethe entire 21st century. Lowering interest rates to zero doesn't mean it's free to borrow more;the principal payments loom large in every student loan, auto loan, mortgage, etc.

.

.

There's less--a lot less--available to fund more borrowing after those stagnating wagespay for rent or a mortgage/property taxes, healthcare, childcare, student loans, etc.This chart depicts healthcare costs, but rent, childcare, higher education, etc. allmirror similar increases.

.

.

.

.

"Borrowing our way out of debt" generates the three Ds of Doom: debt leads to default whichushers in Depression.

dub

- Forums

- Economics

- The Three Ds of Doom: Debt, Default, Depression (Charles Hugh Smith)

The Three Ds of Doom: Debt, Default, Depression (Charles Hugh Smith)

- There are more pages in this discussion • 10 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)