* US market cooled post-Fed, Dow -305pts, S&P500 -0.14%, Nasdaq +0.16%

* NVIDIA continues upward +3.12% to $942, Apple flat +0.53%

* AUD renewed weakness at 65.14c reflecting a generally down day for commodities

* WTI Crude -0.54% to $80.63, Silver -0.28%, Platinum -1.09%, Palladium -2.31%, Iron Ore - 1.6%

* Gold down -$16 or -0.74% to $2165, GDX -1.2% GDXJ -1.39%

* BTC -3.89% to $62,863

* Banks broadly lower XLF -1.19%, JPM -1.21%, Morgan Stanley -1.58%, Goldman -1.67%

* Oil stocks modestly lower XLE -0.25%

* Lithium stocks chalked notable losses: LIT -1.98%, ALB -3.2%, SQM -3.15% except LAC (Lithium America- a featured stock here at the start of the month) +8.11% (see below)

Its Over, 72834977, page-20646 | HotCopper Forum

'Powell Put' Sparks Surge In Stocks, Bonds, & The Dollar; Bullion & Black Gold Flat On Week

BY Zero Hedge

SATURDAY, MAR 23, 2024 - 07:20 AM

Positive macro, central bank love-fest, and AI catalysts... buy all the things...

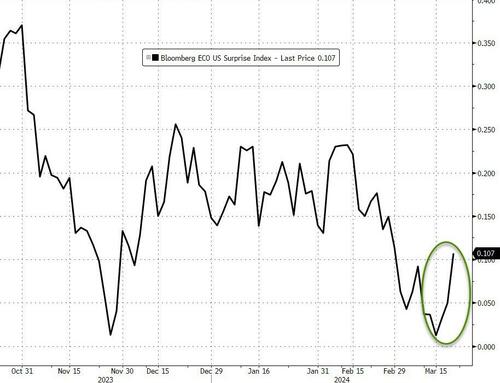

US Macro 'outperformed' expectations this week amid more pro-cyclical data points...

Source: Bloomberg

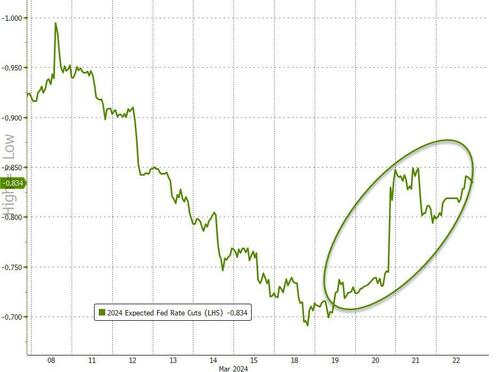

...which combined with a dovish tilt by Powell (which lifted 20-24 rate-cut expectation)...

Source: Bloomberg

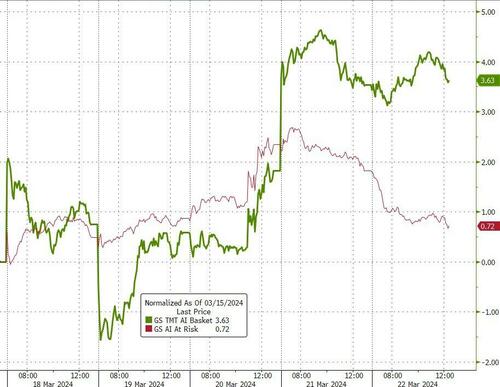

...and positive AI catalysts...

Source: Bloomberg

Put this all together - rates, growth, and secular momentum --and it is perhaps not surprising that stocks have reached another all-time high in the US.

Led to a solid week for all the majors with Nasdaq outperforming...

The S&P 500 trades at a 2025 P/E of 20+.

So the question may simply be: can the rates/growth/secular innovation dynamic be sustained long enough to allow corporate earnings to grow into the current market's valuation?

Shorts were aggressively squeezed Wednesday an Thursday...

Source: Bloomberg

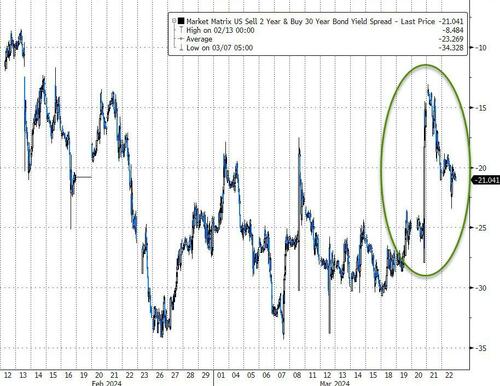

Treasury yields ended the week lower, including the long-end (-4bps), but the short-end outperformed (-13bps)...

Source: Bloomberg

Which left the curve (2s30s) stepper on the week....

Source: Bloomberg

The dollar roared back to six week highs this week...

Source: Bloomberg

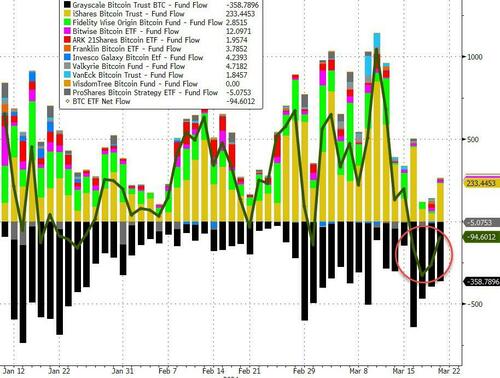

Bitcoin ETFs saw large net outflows this week...

Source: Bloomberg

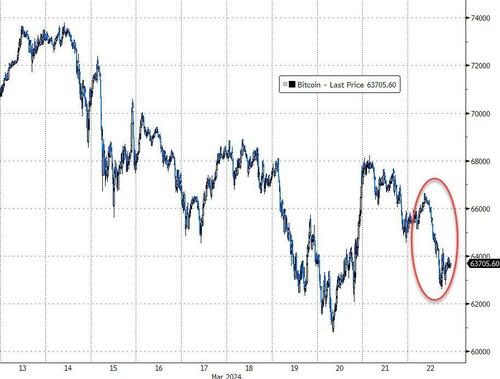

And that weighed on the underlying with spot bitcoin back at $64,000...

Source: Bloomberg

Gold ended the week around unchanged, despite a hige spike intraweek to a new record high...

Source: Bloomberg

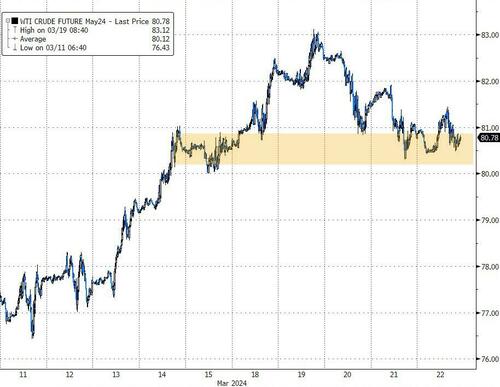

Crude prices ended the week unchanged, roundtripping from the early week gains...

Source: Bloomberg

And finally, this is not good news for Biden and his biddies...

Source: Bloomberg

Pump prices are heading up... and Biden's approval rating down at the sane tune.

- Forums

- ASX - General

- Its Over

* US market cooled post-Fed, Dow -305pts, S&P500 -0.14%, Nasdaq...

- There are more pages in this discussion • 901 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)